How to Choose the Right Payroll Schedule for Your Employees

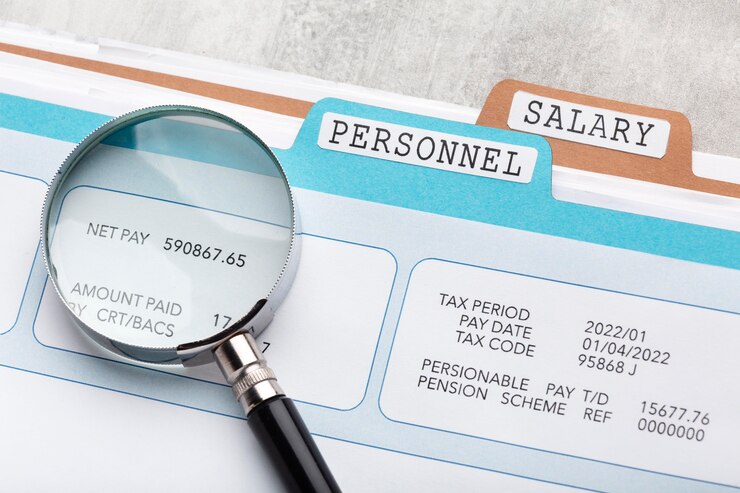

Let’s face it—payroll isn’t the most glamorous part of running a business, but it’s one of the most important. Deciding how often to pay your employees is a big decision that affects not just your team’s satisfaction but also your cash flow and administrative workload. So, how do you figure out what’s right for your […]

Payroll Taxes Explained: What Employers Need to Know

As a small business owner, you’re juggling countless responsibilities—managing operations, delighting customers, and leading your team. But when it comes to payroll taxes, the process can feel like navigating a maze. Don’t worry; you’re not alone! Payroll taxes might seem intimidating, but with a clear understanding, you can stay compliant and avoid costly mistakes. What […]

The Benefits of Having Your HR, Payroll, and Bookkeeping with One Provider

Running a small business requires juggling many responsibilities, and managing HR, payroll, and bookkeeping can be particularly challenging. These functions are critical to your business’s success, yet they can also be time-consuming and complex. Partnering with a single provider like MAVENTRI for all these services can offer numerous advantages. Here, we explore the key benefits […]

How to Craft Your Employee Handbook to Ensure Compliance

Creating an employee handbook is an essential task for any business. It serves as a guide for employees, outlining your company’s policies, procedures, and expectations. However, beyond just being a reference tool, an employee handbook is crucial for ensuring your business complies with various legal and regulatory requirements. At MAVENTRI, we understand the complexities involved […]

Fractional HR vs. Full-Time HR: Which is Right for Your Business?

As businesses grow and evolve, so do their human resources needs. For many companies, the decision between hiring a full-time HR professional or opting for fractional HR services can be challenging. Each option has its own set of benefits and drawbacks, and the right choice often depends on the unique needs and circumstances of your […]

Navigating Payroll Taxes for Small Businesses in Northern Virginia

Running a small business in Northern Virginia involves various responsibilities, with payroll taxes being one of the most critical yet complex aspects. Proper management of payroll taxes is essential for compliance with federal, state, and local regulations, and it helps avoid penalties and ensures smooth business operations. Here’s a comprehensive guide to help small businesses […]

Salaried Exempt Threshold Change: What You Need to Know About Extending Overtime Protection

The Federal Department of Labor (DOL) has introduced a significant change to the Salaried Exempt Threshold, which will impact many employers and employees. This ruling aims to ensure fair compensation for workers who put in extra hours, by raising the minimum salary required for an employee to be considered exempt from overtime pay. Here’s what […]

The Federal Trade Commission’s Final Non-Compete Rule: What It Means for Your Business

The Federal Trade Commission (FTC) has recently introduced a significant change to employment law that could have far-reaching implications for businesses across the United States. The final non-compete rule, announced by the FTC, aims to limit the use of non-compete clauses in employment contracts. This development is designed to promote fair competition, enhance worker mobility, […]

How much of your business’s budget should be dedicated to HR?

Budgeting for human resources (HR) is a critical aspect of financial planning for small and medium-sized businesses. While there is no one-size-fits-all answer to how much of your business’s budget should be dedicated to HR, there are several factors to consider when setting your HR budget. Examine HR Norms in Your Industry Industry norms play […]

What is the easiest way to do payroll for small businesses?

Navigating payroll for small businesses can be a daunting task, especially for entrepreneurs juggling multiple responsibilities. However, the good news is that there are various options available to simplify the payroll process and ensure accuracy and compliance. The easiest way to manage payroll for small businesses depends on the unique needs of your business and […]

Navigating Washington, D.C. Labor Laws: A Guide for Employers

Washington, D.C., is not only the capital of the United States but also a jurisdiction with its own set of unique labor laws and regulations. As an employer in the District, it’s crucial to understand and comply with these laws to ensure a fair and safe workplace for your employees. Here’s a guide to some […]

How Fractional HR Professionals Develop a Tailored Performance Review Strategy

Performance reviews are a critical component of any successful business, providing valuable insights into employee performance and development. However, crafting an effective performance review strategy requires careful planning and expertise. This is where fractional human resource (HR) professionals can make a significant impact. Fractional HR professionals bring a wealth of experience and expertise to the […]

How do HR and Accounting work together?

Human Resources (HR) and Accounting are two important departments within any organization, each with its own set of responsibilities and functions. While HR focuses on managing and developing the organization’s workforce, Accounting is responsible for managing financial transactions and reporting. Despite their distinct roles, HR and Accounting often work closely together to ensure the overall […]

Do small businesses really need HR?

As a small business owner, you may find yourself wearing many hats, from managing finances to handling customer service. With so many responsibilities, you might wonder if having a dedicated HR department is necessary for your business. While the size and structure of your business will ultimately determine your HR needs, there are several reasons […]

Why Outsourcing Payroll is an Incredible Move for Small Businesses

Managing payroll is a critical function for small businesses, but it can be complex, time-consuming, and prone to errors. Outsourcing payroll is an increasingly popular solution that offers numerous benefits, including cost savings, increased efficiency, and reduced compliance risks. In this comprehensive guide, we’ll explore the benefits of outsourcing payroll and why it’s a smart […]

How Fractional Human Resources Can Help Your Business

In today’s competitive business landscape, companies are constantly seeking ways to optimize their operations and drive growth. This is why we’ve seen the use of fractional human resources (HR) services gain traction in recent years. This approach allows businesses to access the expertise of HR professionals on a part-time or project basis, providing cost-effective solutions […]

Outsourcing vs In-House: Choosing the Right Payroll Solution

In the rapidly evolving business landscape, one critical decision that small and medium-sized businesses often grapple with is whether to manage payroll services in-house or seek outsourced support. This decision hinges on numerous factors, including specific needs, budget constraints, and compliance requirements. Understanding In-House Payroll Management In-house payroll management involves handling payroll processes internally, typically […]

Navigating Payroll for Government Contractors: Key Compliance Tips

Government contracts can provide a steady and lucrative source of income for businesses, but they come with a unique set of rules and regulations. Navigating payroll for government contractors can be particularly challenging, as compliance requirements can be complex and failure to adhere to them can result in severe penalties. Let’s explore essential compliance tips […]

Navigating HR Challenges in the Remote / Hybrid Work Era: A Guide for Small Businesses

The workforce has undergone a transformative shift, with remote and hybrid work models becoming increasingly prevalent. While this change brings numerous benefits, it also presents unique challenges for small businesses trying to adapt their human resources practices to this new reality.In addition to the compliance challenges, there are team management challenges faced by small businesses […]

The Vital Role of Dedicated HR Teams in Non-Profits: Ensuring Compliance and Beyond

In today’s fast-paced world, where organizations strive for growth and development, nonprofit organizations (NPOs) stand as pillars of positive change. Despite their noble missions, NPOs often operate on tight budgets and limited resources, making it essential for them to prioritize their efforts effectively. One area that requires utmost attention is human resources (HR) management. In […]

Ensuring a Hassle-Free Tax Season: Why a Dependable Bookkeeper is Essential to Avoiding IRS Audits

Tax season can be a stressful time for both individuals and businesses. The fear of an IRS audit looms large for many, but there’s a way to significantly reduce the chances of that happening – by hiring a dependable bookkeeper. While bookkeepers don’t file taxes or offer tax advice, their role in maintaining accurate financial […]

Organizing Financial Records and Receipts for Next Year’s Taxes (2023)

As we pass the halfway mark of the year, it’s an ideal time to get ahead of the game and start organizing your financial records and receipts for next year’s taxes. While tax season may seem far away, taking proactive steps now can save you time, stress, and potentially even money.In this blog post, we’ll […]

The Benefits of Outsourcing Your Payroll: Why it’s Worth the Investment

Managing payroll is an essential but can be a time-consuming task for businesses of all sizes. It involves various complexities, legal compliance, and the need for accuracy. As businesses strive for efficiency and growth, many are turning to outsourcing payroll services to alleviate the burden and streamline their operations. In this blog post, we will explore […]

How to Choose the Right Payroll and HR Software for Your Growing Business

As your business grows, so does the complexity of managing your workforce and ensuring accurate payroll processing. Manual payroll and HR tasks can be time-consuming, error-prone, and hinder your business’s growth potential. That’s where choosing the right payroll and HR software comes into play. Let’s explore the key features to consider when evaluating software options, provide […]

Navigating Labor Laws: The Benefits of Working with a Professional HR Provider

In today’s complex business landscape, compliance with labor laws and regulations is a critical aspect of managing a successful organization. However, staying abreast of the ever-changing labor laws can be daunting for many businesses. This is where a professional HR provider can prove invaluable. By outsourcing HR responsibilities to experts in the field, businesses can […]