How to Prepare for a Financial Audit: A Bookkeeper’s Perspective

Just the mention of the word “audit” is enough to raise the heart rates of most small business owners. But trust me—as your bookkeeper, I’ve got your back. Audits might seem intimidating at first glance, but they don’t have to be. In fact, a financial audit can actually be a valuable experience, giving you greater […]

Understanding the Basics: What Does a Bookkeeper Do for Your Small Business?

Running a small business is an exhilarating journey filled with opportunities, challenges, and a whirlwind of responsibilities. Among the many hats you wear, one of the most critical yet often overlooked areas is bookkeeping. But what exactly does a bookkeeper do, and why is their role so essential for your small business? What is Bookkeeping? […]

The Benefits of Having Your HR, Payroll, and Bookkeeping with One Provider

Running a small business requires juggling many responsibilities, and managing HR, payroll, and bookkeeping can be particularly challenging. These functions are critical to your business’s success, yet they can also be time-consuming and complex. Partnering with a single provider like MAVENTRI for all these services can offer numerous advantages. Here, we explore the key benefits […]

Bookkeeping for Northern Virginia Start-Ups: What You Need to Know to Stay Compliant

Starting a new business in Northern Virginia is an exciting venture, but it comes with its fair share of challenges, especially when it comes to bookkeeping and staying compliant with local regulations. As a start-up, it’s crucial to establish a solid foundation for your financial management early on to avoid costly mistakes down the road. […]

Best Practices for Managing Accounts Payable and Receivable to Maintain Healthy Cash Flow

Managing accounts payable (AP) and accounts receivable (AR) is essential for maintaining a healthy cash flow in your business. Efficient management of AP ensures that you pay your vendors on time, while effective AR management helps you collect payments from your customers promptly. In this blog, we’ll share some best practices for managing AP and […]

Separating Business and Personal Expenses: Mastering Financial Hygiene

Navigating the world of entrepreneurship can be tricky, but managing your finances is key to keeping your business afloat and growing. One important rule is to keep business and personal expenses separate. In this blog post, we’ll explore why this is so important and share some easy tips to help you do it right. The […]

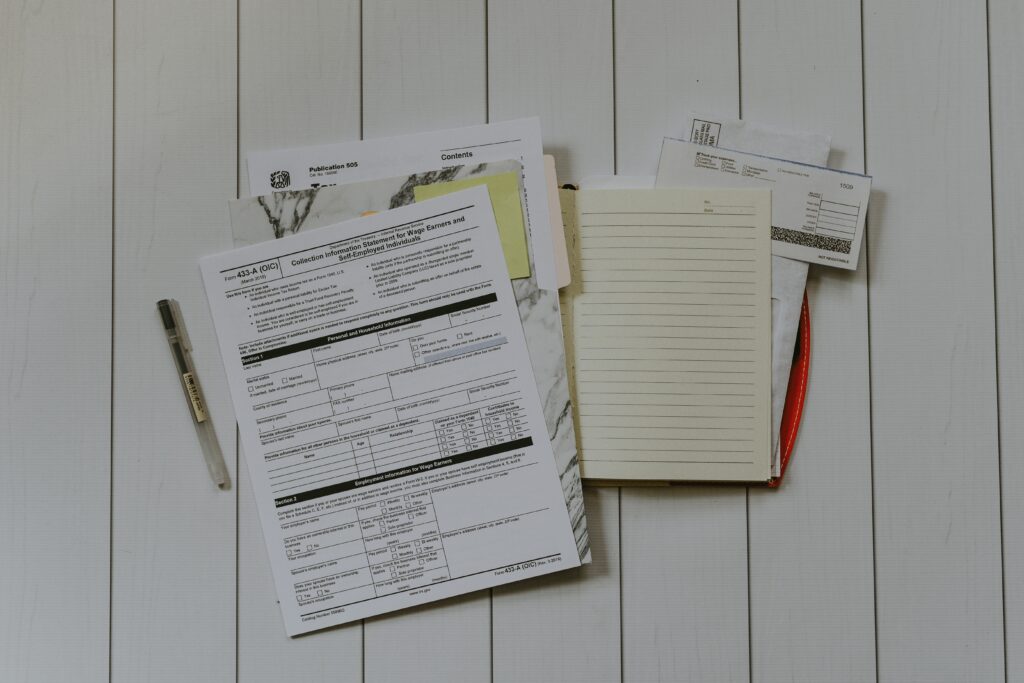

The Basics of Business Taxes

Navigating the complexities of business taxes is a crucial aspect of running a successful business. As a business owner, understanding your tax obligations and responsibilities can help you avoid costly mistakes and ensure compliance with tax laws. Keep reading to learn more about what business owners should know about business taxes. Understanding the Types of […]

How to Effectively Analyze Your Financial Statements

Financial statements are a crucial tool for understanding the financial health of a business. They provide a snapshot of a company’s performance and help stakeholders make informed decisions. Analyzing these statements can seem daunting, but with the right approach, anyone can gain valuable insights into a company’s operations. Let’s explore the key components of financial […]

Do I need a bookkeeper if I have Quickbooks?

Small business owners often wear many hats, from managing operations to overseeing finances. With the rise of user-friendly accounting software like QuickBooks, many entrepreneurs wonder if they still need a bookkeeper. While QuickBooks can be a powerful tool for managing finances, it’s essential to understand its limitations and consider your business’s unique needs before deciding […]

The Best Bookkeeping Method for Small Businesses

Bookkeeping is a crucial aspect of managing a small business that is often overlooked and under-utilized. At MAVENTRI, we find that many small business owners find bookkeeping overwhelming, leading to errors and financial mismanagement – and let’s be honest, no small business owner wants to be worrying about money. Let’s discuss the best bookkeeping method […]

The Difference Between Bookkeeping & Accounting: Unraveling Two Essential Components of Financial Management

When it comes to managing finances for any business, two crucial aspects often get intertwined, causing confusion among entrepreneurs and small business owners: bookkeeping and accounting. While both functions are essential for maintaining accurate financial records, they serve distinct purposes and require different skill sets. In this blog post, we will delve into the key […]

Ensuring a Hassle-Free Tax Season: Why a Dependable Bookkeeper is Essential to Avoiding IRS Audits

Tax season can be a stressful time for both individuals and businesses. The fear of an IRS audit looms large for many, but there’s a way to significantly reduce the chances of that happening – by hiring a dependable bookkeeper. While bookkeepers don’t file taxes or offer tax advice, their role in maintaining accurate financial […]

The Importance of Bookkeeping in the Cannabis Industry

Today, we’re shedding light on cannabis industry, a sector that has seen tremendous growth in recent years—the cannabis industry. With its rapidly evolving landscape and unique financial considerations, the cannabis industry demands a proactive and precise approach to bookkeeping. Whether you’re a dispensary owner, cultivator, or cannabis product manufacturer, maintaining accurate financial records is essential […]

Maximizing Deductions for Small Businesses: A Comprehensive Bookkeeping Guide

As a small business owner, maximizing deductions is a key aspect of optimizing your financial situation. By effectively tracking and categorizing expenses, you can ensure that you take advantage of all eligible deductions, ultimately reducing your taxable income and saving money. In this bookkeeping guide, we will explore various strategies to help small business owners maximize […]

Streamline Your Small Business Finances with Xero and QuickBooks Online

Efficient financial management is vital for small businesses to thrive and grow. Manual bookkeeping and paper-based processes can be time-consuming and prone to errors. Thankfully, modern technology offers user-friendly solutions to streamline these tasks and provide real-time financial insights. In this blog post, we will explore how Xero and QuickBooks Online can revolutionize your small business […]

Common Bookkeeping Mistakes to Avoid for Washington, D.C. Nonprofit Organizations

Managing the finances of a nonprofit organization is crucial for its success and sustainability. In Washington, D.C., which ranks third in the United States for having the highest number of nonprofit organizations, it becomes even more essential for these organizations to maintain accurate and reliable bookkeeping practices. This blog post aims to provide practical advice to […]

How Much Does a Bookkeeper Cost for a Small Business? (2023)

How much does small business bookkeeping cost? As a small business owner, keeping track of your financial records is essential for the success of your business. But how do you know if you should handle bookkeeping yourself or hire a professional? And if you decide to hire a bookkeeper, how much can you expect to […]

How Bookkeepers Support Tax Accountants During the Busy Tax Filing Season (2023)

If you’re a business owner who hasn’t yet hired a bookkeeper, now is the time to do so. For tax accountants, working with a bookkeeper can help them focus on their core responsibilities of preparing and filing tax returns.

Why Virtual Bookkeeping Services Are Great for Small Businesses

By outsourcing your bookkeeping needs to a virtual firm, you can enjoy all the benefits of having a full-time staff member without the overhead costs.

The Difference Between a Bookkeeper and an Accountant

Even the most astute business owners and managers can make the mistake of interchanging the terms Bookkeeper and Accountant. What’s the difference?

Treat Your Household Budget Like a Business

Have you argued about money with your significant other? Financial matters cause fights for 35 percent of couples, which makes it the single biggest point of contention in a relationship. It’s easy to have emotionally charged conversations about finances, but you can reduce the risk of this happening by treating the household budget as a business.

Bookkeeping Can Double as a Business Plan

Good bookkeeping can give you more than well–balanced books and neatly reconciled bank statements.

What To Look For In Modern Bookkeeping Services

When looking for bookkeeping services, it is important to do your research and find a service that meets your needs.